According to the local bank, the UOB One Account interest rate change is required “to align with long-term interest rate environment expectations.”

UOB has announced that it will reduce the interest rates for its flagship savings account starting from May 1, becoming the first local bank to take this step amid growing market anticipation of potential rate cuts by the US Federal Reserve in the near future.

In a letter sent to its customers on Monday (Apr 1), the adjustment in interest rates for its UOB One Account is attributed to the bank’s efforts to align with expectations regarding the long-term interest rate environment.

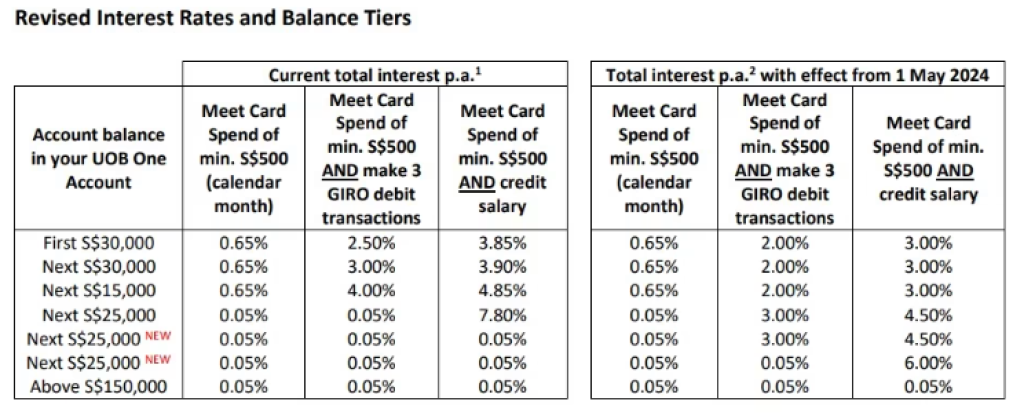

Similar to DBS and OCBC’s flagship savings accounts, UOB’s One account offers tiered interest rates that increase as customers grow their account balance or fulfill certain criteria such as spending a minimum amount on select cards or engaging in other transactions like taking up a mortgage with the bank.

In late 2022, these banks implemented substantial increases in interest rates for their flagship savings accounts amidst a rising rate environment. UOB notably offered the highest maximum interest rate at 7.8 percent.

However, with the recent announcement, UOB has adjusted the tiered interest rates for One account holders with balances up to S$100,000, who credit their salary to the bank and meet a minimum monthly spend of S$500 on an eligible bank card. These rates will now range from 3 percent to 4.5 percent per annum, marking a decrease from the previous range of 3.85 percent to 7.8 percent.

UOB is introducing two new tiers for its One account, but account holders must maintain account balances exceeding S$100,000 to qualify for these tiers. Additionally, they must meet the same criteria of crediting their salary to the bank and fulfilling the minimum spending requirements.

For instance, the interest earned on balances ranging from S$100,000 to S$125,000 will increase to 4.5 percent per annum from the current rate of 0.05 percent.

Similarly, savings amounts falling within the S$125,000 to S$150,000 tier will now earn the maximum bonus interest rate of 6 percent per year, a significant rise from the existing rate of 0.05 percent.

“With these adjustments, you can potentially earn up to S$6,000 in total interest within a year for deposits of S$150,000, provided you spend a minimum of S$500 on eligible UOB Cards and credit your salary via GIRO/PayNow each calendar month,” UOB stated.

Currently, OCBC offers a maximum interest rate of 7.65 percent per year for its 360 savings account, while DBS’ Multiplier account offers the highest rate of 4.1 percent per annum.

When queried by CNA, OCBC did not indicate any immediate changes in interest rates, although the bank mentioned that it regularly assesses its product offerings to stay competitive and aligned with market conditions.

“We are committed to providing our customers with products and services that cater to their savings and wealth accumulation requirements,” stated Tan Siew Lee, Head of Group Wealth Management at OCBC.

CNA has reached out to DBS to inquire about any potential adjustments to interest rates for its flagship savings account.

During its recent policy meeting, the US central bank opted to keep its benchmark overnight interest rate unchanged while maintaining its forecast for three reductions in borrowing costs throughout the year.

Fed Chair Jerome Powell has emphasized that the timing of these rate cuts hinges on officials gaining greater confidence in the sustained decrease of inflation toward the central bank’s 2 percent target, even as the economy continues to surpass expectations.

Despite the Fed’s cautious stance, Vasu Menon, Managing Director of Investment Strategy at OCBC, noted that “markets still anticipate a rate cut by the US central bank in June, with a 60 percent probability.”

Market observers will closely monitor inflation and household spending data in the upcoming months.

“There are expectations that consumer spending might soften, particularly as real disposable income growth decreased in February… Concurrently, core services inflation is decelerating and may persist throughout the year,” Mr. Menon stated in a note on Monday.

“By the time the Fed convenes in June, there’s optimism that economic and inflation figures could be compelling enough for them to initiate rate cuts,” he further added.