There is never a bad time to begin planning for retirement. We’ll talk about some of the top retirement planning options in Singapore in this blog article. We have compiled a list of our top retirement planners who provide tools like income replacement ratio analyses and retirement calculators. Additionally, you’ll discover how to collaborate with your financial adviser in retirement to make sure you’re achieving your retirement goals!

Best Retirement Planning in Singapore

| Services | Retirement Plan |

| Operating Hours | 24 Hours |

| Contact Details | +65 3163 9184 hello@policypal.com |

| Address | JustCo, OCBC Centre East 63 Chulia Street, #15-01 Singapore 049514 |

| Website | https://www.policypal.com/ |

We may provide you the choice to select from a range of various insurance plans, each of which has its own set of advantages and disadvantages. Term lengths ranging from one year to life or permanent incapacity, waivers of upcoming premiums, and tax-free withdrawals from your SRS savings account are among the several insurance coverage options you have. PolicyPal can help you select retirement insurance depending on your requirements and financial situation.

Highlights:

- Value for money

- Customer-oriented

- Time-Saving

Great company with a great product that helped me greatly in comparing different insurances. Was able to seamlessly purchase travel insurance every time I travel. Definitely cannot do without this app on my phone. – Muji Tekapo

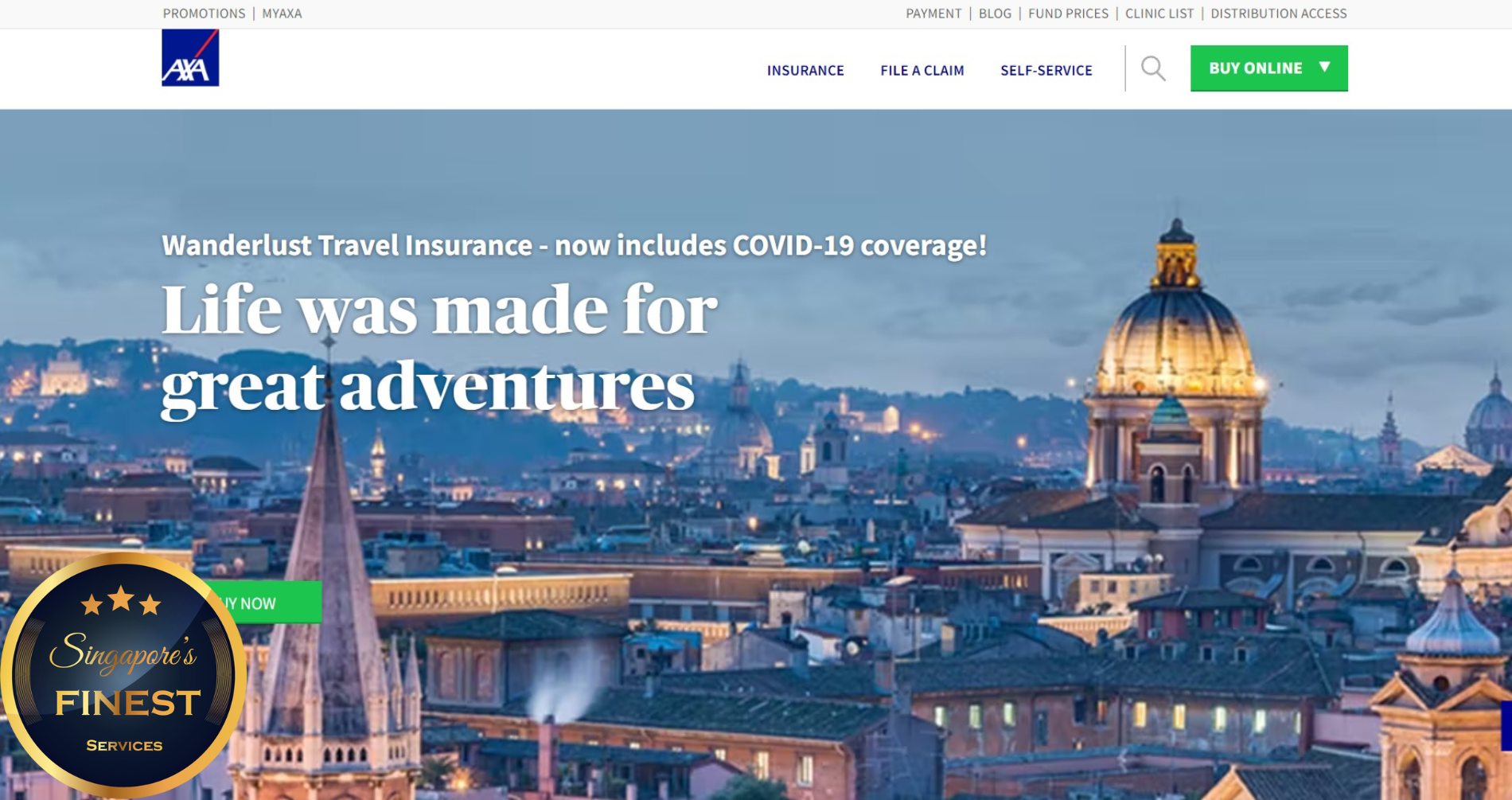

| Services | Retirement Plan |

| Operating Hours | Monday – Friday, 9:00 AM – 5:30 PM |

| Contact Details | +65 6880 4888 customer.care@axa.com.sg |

| Address | 8 Shenton Way, #24-01 AXA Tower, Singapore 068811 38 Beach Road, #03-11, South Beach Tower, Singapore 189767 |

| Website | https://www.axa.com.sg/savings-investments/axa-retire-happy-plus-ii |

One of the top retirement plans in Singapore is Retiree Happy Plus from AXA Financial because of its flexible payment schedule and extensive coverage. You have control over your retirement age with Retire Happy Plus. Depending on how quickly you want to start receiving your benefits, you can start retiring as young as 50.

Highlights:

- Choice of retirement

- Flexible payment terms

- Death benefit

Made a claim for medical expenses and I got my payment in 3 weeks. – Winnie Tan

| Services | Retirement Plan |

| Operating Hours | Monday To Friday: 9.30 AM to 5.30 PM |

| Contact Details | hello@dollarbureau.com hello@singaporefinancialplanners.com |

| Address | 10 Anson Road, #33-03 International Plaza, Singapore 079903 |

| Website | https://dollarbureau.com/singapore-financial-planners/ |

Because Singapore Financial Planners will help you, you won’t have to worry about having a stable and secure future any longer! They are one of Singapore’s top insurance and investment companies due to its highly qualified financial advisors, extensive coverage, and perks.

Highlights:

- Accommodating staff

- Professional and highly trained financial consultants

- Wide range of insurance

After talking to many financial consultants, Singapore Financial Planners impressed me as they really took time to understand my current situation and what my goals were before recommending me their products. They developed an action plan that I could follow and were super patient and understanding. Highly recommended! – Firdaus Syazwani

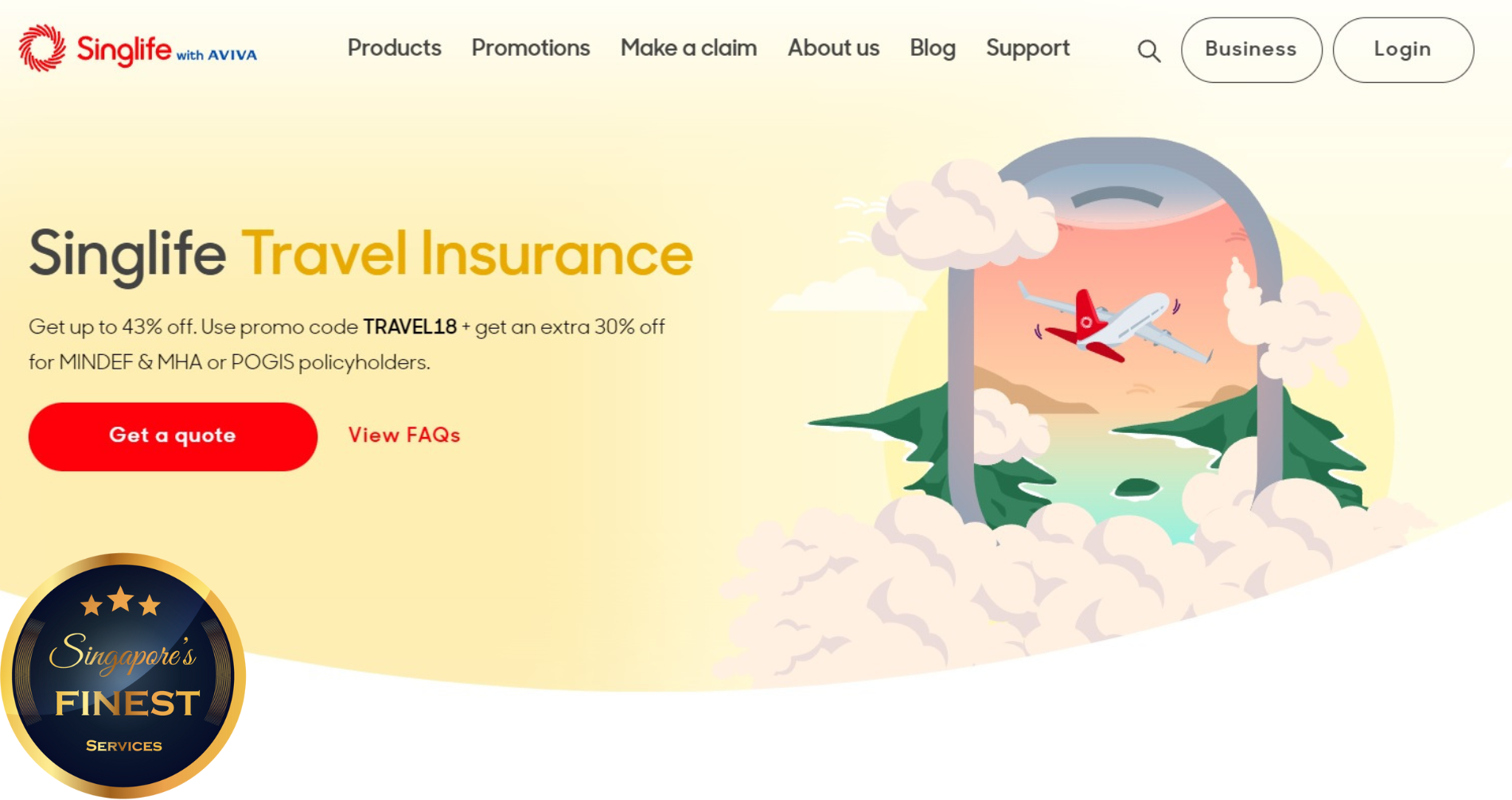

| Services | Retirement Plan |

| Operating Hours | Monday – Friday, 8:45 AM – 5:30 PM |

| Contact Details | +65 6827 9933 singlifeonline_ITHelpdesk@singlife.com |

| Address | 4 Shenton Way, #01-01 SGX Centre, Singapore 068807 |

| Website | https://singlife.com/en |

We work with you to get financial independence. At every stage of your life, we offer you control over your financial situation. We are more than simply an insurance business when we work together. We are a financial services partner with a focus on technology. Your better path to financial independence is with us.

Highlights:

- Hassle-free application

- Choice of retirement age

- Flexible premium terms

Had a great claims experience under the Group Insurance policy I have with Aviva. The customer Service Exec was extremely helpful and helped with a letter of guarantee which resulted in cashless hospitalization. All in all, they did what they suppose to do – paid my claim! – Sapna Kalra

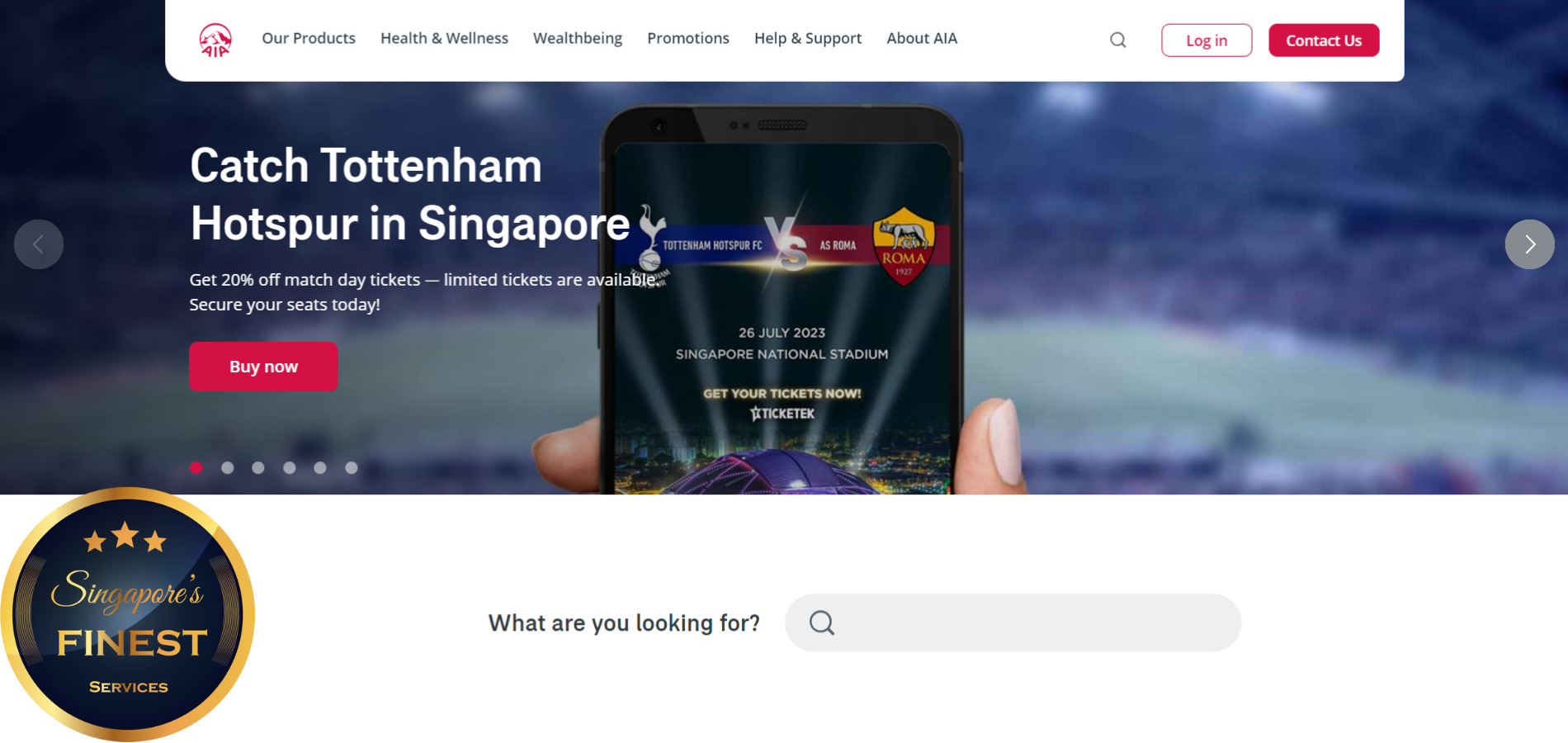

| Services | Retirement Plan |

| Operating Hours | Monday – Friday, 8:45 AM – 5:30 PM |

| Contact Details | +65 1800 248 8000 |

| Address | 1 Robinson Rd, AIA Tower, Singapore 048542 |

| Website | https://www.aia.com.sg/en/our-products/savings/aia-retirement-saver-iv.html |

Due to its extensive coverage and flexible payment schedules, The Retirement Saver (III) is Singapore’s most well-liked retirement plan. Although well-known for its adaptable compensation structure, it falls short when it comes to monthly retirement benefits. Only 15 years of income can be guaranteed by Retirement Saver (III) if other plans offer lifetime benefits.

Highlights:

- Future returns

- Flexible payment terms

- High-quality service

Thanks, Alex Tan for the help to introduce a few good insurance plans for me to ready myself for the future. He definitely deserved the 5stars rating. – Koh Fu

| Services | Retirement Plan |

| Operating Hours | Monday – Friday, 9:00 AM – 6:00 PM |

| Contact Details | +65 6833 8188 service@manulife.com |

| Address | 8 Cross Street, #01-01A, Manulife Tower Singapore, Singapore 048424 |

| Website | https://www.manulife.com.sg/en/solutions/save/retirement/retire-ready-plus.html |

Manulife’s RetireReady Plus is the answer if you’re searching for a strategy to guarantee a monthly income for life when you retire in Singapore. It enables retirees to take advantage of their prime years without worrying about their financial security in the future.

Due to its extensive perks and coverage, Manulife has a solid reputation in Singapore as a supplier of top-notch retirement plans. One of its benefits is death coverage, which spares your loved ones the money if something were to happen to you.

Highlights:

- Guaranteed monthly income

- High-quality services

- Death coverage

I would like to thank Mr. Choah Wee Su for his excellent follow-up. He Is willing to go the extra mile to help & clear my doubts regarding my insurance policy. I feel that his hard work should not go unrecognized. – Lee Florence

| Services | Retirement Plan |

| Operating Hours | Monday – Friday, 10:00 AM – 7:00 PM |

| Contact Details | +65 6788 1777 |

| Address | 3 Gateway Dr, #02-40B Westgate, Singapore 608532 |

| Website | https://www.income.com.sg/savings-and-investments/gro-retire-flex-pro |

For those looking for a Singapore retirement plan with frequent incentives, Income’s Gro Retire Ease is the best choice. You won’t need to worry about anything when it comes to retirement when you’re protected by one of Singapore’s best and most affordable retirement plans.

Highlights:

- Frequent bonuses

- Choice of retirement age

- Death and accident benefits

Service here was great! The staff is very helpful and you get help with anything you need in a professional and fast manner! First time coming here to make an insurance claim and I was attended to instantly as I reached! Overall a good place! – Wilfred Loy Yong Kang

| Services | Retirement Plan |

| Operating Hours | Monday to Friday: 9 AM – 6 PM |

| Contact Details | +65 6329 9188 enquiries@moneyowl.com.sg |

| Address | 23 Keong Saik Road Singapore 089130 |

| Website | https://www.moneyowl.com.sg/ |

MoneyOwl has received a license from the MAS to operate as a money management and financial advisory business. They aim to make smart financial decisions for you so that you may enjoy your life to the fullest. Unlike other firms, they offer an app that builds a customized retirement plan based on the user’s monthly income and predicted yearly costs over the course of their working career.

Highlights:

- Affordable Rates

- Highly customizable plans

- Has a mobile application for easier access

- Available after office hours by appointment

Had a very good experience chatting with MoneyOwl about my plan. My advisor was very patient and answered all my questions. He was also very thorough in going through every detail of my plan. – Celeste Heng

In Singapore, retirement planning has made significant advancements. Retirement planning in Singapore is centered on practical outcomes for everything from retirement logistics to retirement benefits to retirement timetables and tactics.

Do check out our list of Cruise Insurance and have time to check their services.

Frequently Asked Questions

FAQs

What is the 4 rule of retirement spending?

What is the 3 rule in retirement?

What is the most popular retirement plan?

You might be interested in

Related Lists

The Finest Retirement Planning in Singapore

We curated the top retirement planning in Singapore. Check out their services and let us know if they serve you the best way possible.

Product Currency: SGD

Product Price: 100-500

Product In-Stock: InStock

4.5