In Singapore, starting a home improvement project may be a thrilling but expensive venture. Renovation Loans in Singapore may be a useful financial instrument to help you realize your dream of improving your living area. We’ll delve into the nuances of renovation loans in this extensive guide, illuminating your options and offering guidance to help you make wise choices. Join us on this trip to learn how Renovation Loans may be the key to turning your home fantasies into real, exquisitely remodeled places, whether your goals are little tweaks or a big overhaul.

Best Renovation Loans in Singapore

| Key Services | Loan Types & Features, Loan Protection Insurance, Loan Repayment Information, Loan Eligibility Criteria |

| Operating Hours | Mon – Fri: 10 am – 6 pm |

| Contact Details | +65 6513 0326 +65 8774 9906 hello@fridayfinance.sg |

| Address | 10 Eunos Rd 8, #09-04 Singapore Post Centre, Singapore 408600 |

| Website | https://www.fridayfinance.sg/ |

The Singapore Ministry of Law’s Registry of Moneylenders has granted Friday Finance a license as a moneylender. Through MyInfo, Friday Finance gives you the option to apply for loans, adding ease and security.

Friday Finance is different from commercial banks, which normally impose a one-time fee. They return 50% of the administrative costs when your loan is fully repaid on time, enabling you to save even more money.

Highlights:

- Online Application

- Affordable & Transparent Pricing

- Refunds 50% of the Administrative Fees when the loan is fully repaid on time

Was a pleasant experience. Before the loan was given, was given a thorough explanation of the terms and conditions involved. Recently took another loan with Friday, and was again vetted thoroughly to ensure I was able to take the loan safely. The process was also quick and efficient. – EnjoyingUrBoredom

| Key Services | Loans, Finance |

| Operating Hours | Monday-Friday: 9:30-3:30 pm Saturday: 9:30-12:00 pm |

| Contact Details | +65 6225 5225 singapore.customer.service@citi.com |

| Address | Locations |

| Website | https://www1.citibank.com.sg/loans/quick-cash-loan |

Customers of Citi Quick Cash are consistently given discounts and bundles, including food discounts whose value is determined by the quantity of the loan. One of Citibank’s most well-liked services is the Citi Mobile App, which enables users to submit a loan application via a smartphone. With a flexible repayment plan, you can also decide to pay off your debts over the course of 60 months. Any credit limit that isn’t being used can be converted to cash.

Highlights:

- Simple and hassle-free transaction

- Repay plans for up to 60 months

- Enjoy GrabVouchers

No reviews yet as of this writing

| Key Services | Offers the best personal loan from selected partners |

| Operating Hours | Monday to Friday: 9 AM–6 PM Saturday: 10 AM-3 PM |

| Contact Details | +65 9154 1705 contact@lendela.com |

| Address | Funan 109 North Bridge Rd, #07-21 179097 Singapore |

| Website | https://sg.lendela.com/ |

Most likely, you can find the best lender for your loan needs (and wants!) through the first option on our list. One of the most challenging parts of getting a home renovation loan in Singapore is looking for the right lender and monitoring the status of your application. Fortunately, Lendela takes care of these problems by making sure that your loan is approved and handled as promptly as possible.

Lendela is proud of its Fintech platform, which makes it simple for customers to find the best loan options for them. Lendela’s services are transparent by nature because they make sure to notify you as soon as a potential offer from one of their affiliated lenders becomes available. Finally, they are there to help you at every turn. They will make sure you are aware of all of your alternatives and choose a loan that meets your requirements and price range.

Highlights:

- Receive multiple, personalized loan offers

- Apply, compare & choose online for free

Very useful in finding me the necessary institutions for my needs! – Riel

| Key Services | Personal Loans, Insurance, |

| Operating Hours | 24-hour customer service online |

| Contact Details | Click here for contact |

| Address | |

| Website | https://omy.sg/ |

Looking for the latest news and tips for living well in Singapore? OMY Singapore is your one-stop shop! Our website offers easy-to-follow guides and insightful articles on everything from finance and business to lifestyle and local happenings. Authored by a dedicated team who loves Singapore, OMY Singapore delivers original content to empower you to make informed decisions and get the most out of life in this vibrant city.

| Key Services | Loans, Deposits, Trade, Treasury, RHB Reflex |

| Operating Hours | 24-hour customer service online |

| Contact Details | +65 6329 6399 sg.ambd@rhbgroup.com |

| Address | 6 Shenton Way 19-09 OUE Downtown 2 Singapore 068809 |

| Website | https://rhbgroup.com.sg/rhb/personal/home-and-property |

For instance, the S$30,000 RHB Renovation & Furnishing Loan offers a minimum 6-times income requirement or S$30,000 (whichever is lower) and a 1 to 5-year repayment duration. You can extend the loan’s repayment period by taking it out. Flat Rate and Monthly Rate are the two available interest rate options.

To be eligible for this loan, you must be between the years of 21 and 55 and a Singaporean or Singapore Permanent Resident. The primary applicant’s annual salary must be at least S$30,000. The joint applicant must earn at least S$30,000 per month in order to qualify for a S$30,000 loan. The main applicant must be the joint applicant’s spouse, parent, sibling, or kid. The primary applicant must also be the owner of the property that will be restored.

Highlights:

- Established Regional Presence

- Award-winning

- Dedicated staff

| Key Services | Loan Agency |

| Operating Hours | Monday to Saturday: 11 AM–8 PM |

| Contact Details | +65 6748 1338 enquiry@creditmaster.sg feedback@creditmaster.sg |

| Address | 531 Upper Cross Street 01-04 Hong Lim Complex Singapore 050531 |

| Website | https://www.creditmaster.sg/ |

If you don’t want to take out a loan from one of the large Singaporean banks, we strongly suggest that you check out Credit Master. One of the best lenders in Singapore, offering a variety of loans for different purposes. Investors and homeowners can both utilize The Credit Master. The corporation, which has been in operation for more than 20 years, offers loans. The company is committed to offering remodeling loans to homeowners at interest rates as low as 2%.

Additionally, obtaining a loan for this amount has never been easier – simply make sure you meet their requirements and provide the required documentation, and you’re good to go! To make sure you are well informed before making a significant decision, you might want to speak with their professional financial advisors if you have any queries about renovations or renovation loans.

Highlights:

- Simple and Private Online Loan Application

- Quick Processing of Application

- Great Customer Service and Feedback

No reviews yet as of this writing

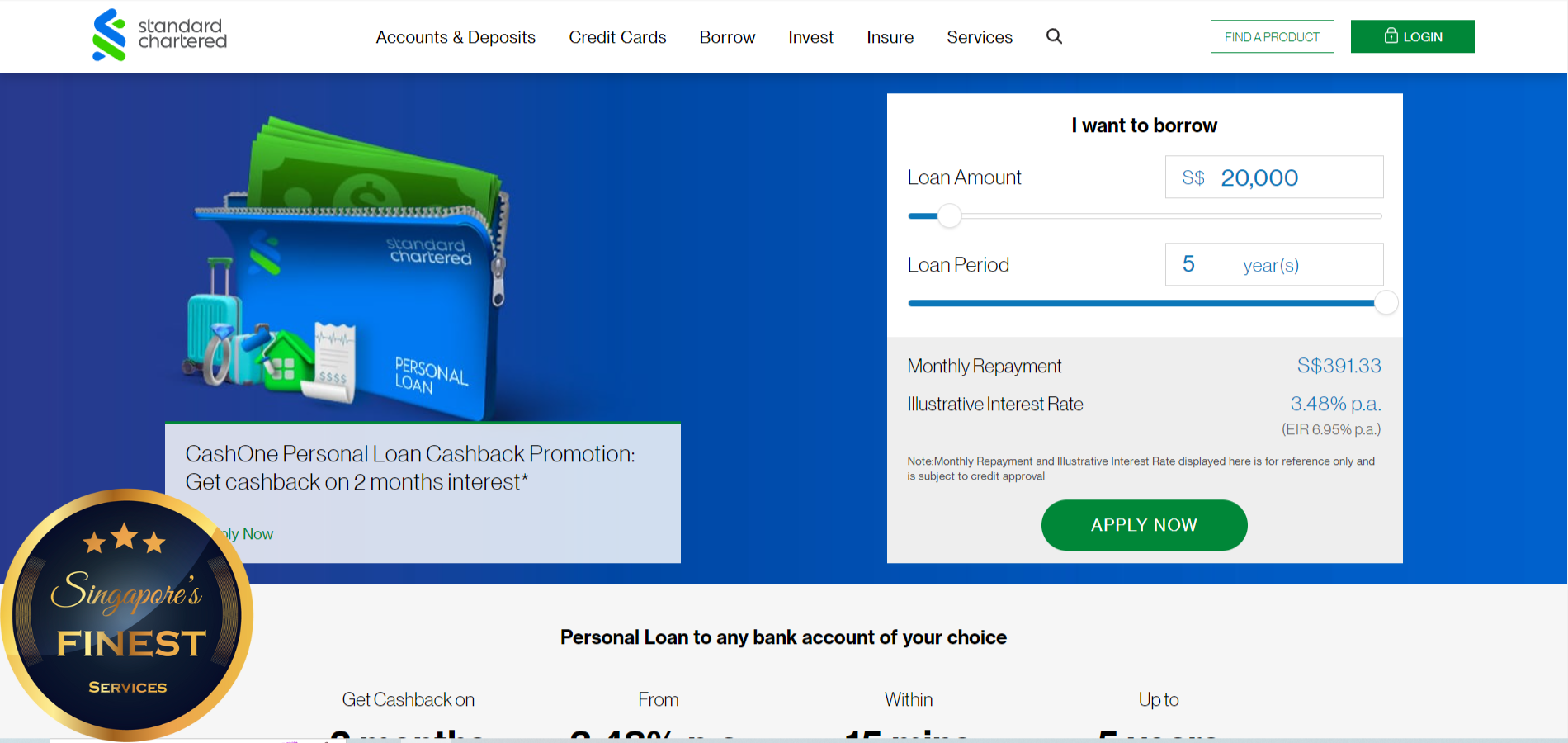

| Key Services | Online Banking, Manage your Finances, Manage your Payments |

| Operating Hours | Monday to Friday: 10 AM–5 PM Saturday: 10 AM–2 PM |

| Contact Details | +65 1800 747 7000 |

| Address | Location |

| Website | https://www.sc.com/sg/borrow/loans/cashone/ |

You can get cashback on personal loans from Standard Chartered CashOne Personal Loan and interest rates as low as 3.48 percent p.a. Within 15 minutes of loan acceptance, funds will be transferred to any already-existing bank account of your choosing. Similar to other lenders, a flexible repayment period of 1 to 5 years is also offered.

If you are between the ages of 21 and 65 and earn at least S$20,000 per year (S$20,000 for Singaporeans and Permanent Residents), you are eligible to apply for a renovation loan. Foreigners must, however, hold a Singapore Employment Pass and earn a minimum of S$60,000 per year. There is no documentation required for Standard Chartered cardholders to apply for this loan. However, if your income has recently changed, you must apply with updated documents for review.

Highlights:

- Cashback Promotion

- 5 years loan tenure

- Enjoy competitive rates

No reviews yet as of this writing

| Key Services | Renovation Loan |

| Operating Hours | Mon – Fri 9:00 am to 5:30 pm Sat 9:00 am to 12:30 pm |

| Contact Details | 1800 339 6666 |

| Website | https://www.posb.com.sg/personal/loans/homeloans/renovation-loan |

If you’re looking for a home remodeling loan in Singapore with lax requirements, the POSB Renovation Loan is a fantastic choice. As long as your annual income is at least S$24,000, you are eligible to qualify for this renovation loan. One of the greatest remodeling loans in Singapore is due to its advantageous terms, coverage, and simple payback process.

Additionally, customers can choose how long they wish to repay the loan. The renovation loan from POSB is substantially larger than the renovation loans from other banks. Repairs to the electrical and wiring, the installation of tile and flooring, built-in cabinets, and various other tasks are all covered.

Highlights:

- Hassle-free online application

- Attractive rates

- Peace of mind

The staff by the name of Lee Michelle was pleasant and accommodating. Thank you so much. – Agnes Ong

In conclusion, as you navigate the exciting realm of home renovation in Singapore, Renovation Loans emerge as a strategic financial ally, facilitating the transformation of your living space. From minor enhancements to major overhauls, the versatility of Renovation Loans empowers you to realize your vision without undue financial strain. We trust that this guide has provided valuable insights into the options available, enabling you to make informed decisions tailored to your renovation needs. Here’s to creating a home that not only reflects your style but also stands as a testament to the seamless synergy of vision and financial prudence. May your renovated spaces be a source of joy and comfort for years to come!

Do check out our list of Debt Collectors and have time to try their services

Frequently Asked Questions

FAQs

Which loan is best for a house renovation?

What is renovation loan Singapore?

Are renovation loans worth it?

Why consider a Renovation Loan in Singapore for home improvement projects?

What types of renovation projects are typically covered by Renovation Loans?

How do Renovation Loans in Singapore differ from other types of loans?

What criteria are considered when applying for a Renovation Loan?

Can Renovation Loans cover both small upgrades and major overhauls?

You might be interested in

Related Lists

The Finest Renovation Loans in Singapore

We have curated a list of the top Renovation Loans in Singapore. Check out their services and let us know if they serve you the best way possible.

Product In-Stock: InStock

4.9