Take a trip through the fascinating world of credit cards in Singapore, where rewards that are unmatched meet financial flexibility. Learn about the nuances of credit card options catered to the changing demands of Lion City in this in-depth investigation. Our guide is your key to navigating the diverse array of credit card possibilities, from special benefits to astute money management advice. It will help you make well-informed decisions that flawlessly fit your financial objectives and lifestyle. Greetings from Singapore, where credit card transactions open up new possibilities with every swipe.

Best Credit Cards in Singapore

| Services | Digital Services, DBS Digibank |

| Price Range | |

| Contact Details | See here |

| Address | Branches |

| Website | https://www.dbs.com.sg/personal/cards/credit-cards/dbs-altitude-cards |

In addition to special price options like up to 10 miles for transactions with Expedia and Kaligo, this card offers 1.2 miles for every S$1 spent locally, 2 miles for purchases made internationally, and 3 miles for purchases made online for travel. Travelers may easily accrue miles (that never expire) and gain benefits like free access to airport lounges, free travel insurance, and golf privileges. If you spend S$25,000—a sizeable number for the average consumer—in the first year and each year after, the annual fee is waived.

Highlights:

- S$1 = 5 miles on online flight & hotel transactions

- S$1 = 5 miles on overseas spend (at point-of-sale)

- S$1 = 2 miles on overseas spending (online transactions)

- S$1 = 1.2 miles on local spend

All the people I’ve spoken to are very nice & helpful. I am now a resident overseas and had to come to update my details & admin took like about 30min. Thanks for Baldwin’s (hope didn’t spell the name wrong) patience! Also very close to a food court. – Nanfan Yi

| Services | Up to 10% cashback on daily spend |

| Price Range | |

| Contact Details | See here |

| Address | Branches |

| Website | https://www.uob.com.sg/onecards/uob-one-credit-card.html |

The UOB One Card is the best way for the majority of users to maximize cashback. A flat discount of up to 5% may be applied; this discount may be extended to 10% for Dairy Farm, Grab, Shopee, and particular UOB Travel services. One of the highest on the market, 3.33 percent is the target earning rate for this spending level. At this spending level, cardholders can earn up to S$300 every quarter, or S$100 per month—one of the strongest possible earnings rates available.

Highlights:

- Get exclusive rewards

- Up to 10% cashback

- Exclusive offers on restaurants, groceries, and many more

Serve by front desk staff Joanne a few times over the last few days. Always polite, helpful, and great service. Thank you. – Sam Ng

| Services | 10% Cashback, Over 1k Deals & Discounts, 10% Cashback, Over 1k Deals & Discounts, SimplyGo, Travel Coverage, Additional Features |

| Price Range | |

| Contact Details | +65 6333 7777 cimb.assists.sg@cimb.com |

| Address | 30 Raffles Place #03-03 Singapore 048622 |

| Website | https://www.cimb.com.sg/en/personal/banking-with-us/cards/credit-cards/cimb-visa-signature.html |

One choice is the CIMB Visa Signature Card. On online purchases, food, health, and beauty/wellness store purchases, as well as cruises, this card offers a 10% cashback rebate. If you frequently conduct business online, enjoy visiting hair salons, spas, and massage parlors, or if you frequently shop at supermarkets, this credit card might be right for you.

Highlights:

- Online application

- 0.2% cash back on other retail purchases with no minimum spend or monthly cap

- 10% cashback on Online Shopping, Groceries, and more

CIMB allows linkage with a Malaysia account which brings convenience as I go to Malaysia frequently since my partner is from there. No other banks currently offer such service and convenience. – Jay Liu

| Services | Cashback on dining, groceries, land transport, and petrol |

| Price Range | |

| Contact Details | See here |

| Address | Branches |

| Website | https://www.ocbc.com/personal-banking/cards/365-cashback-credit-card |

One of the greatest no-fee credit cards for maximizing returns on regular spending is the OCBC 365 Card. On a variety of regular expenditures, such as groceries, utilities, dining and food delivery, and transportation, you can earn 3 percent to 6 percent cashback.

Highlights:

- Get 6% cashback on all dining & online food delivery

- Get 3% cashback on all groceries, land transport, utilities, and online travel

- Get 5% cashback on all fuel spend at all petrol service stations

Great services and help from Jean Tan, Cherie Ong, and Erica!! Thank you very much. – Troy P Teo

| Services | 6% cash back on dining at restaurants and cafes daily, worldwide, 8% cashback on Groceries at supermarkets and grocery stores daily, worldwide, Up to 20.88% fuel savings |

| Price Range | |

| Contact Details | See here |

| Address | Branches |

| Website | https://www.citibank.com.sg/credit-cards/cashback/citi-cash-back-card/ |

The Citibank Cash Back Card is well-known for a reason: you can earn up to 8% cashback on your grocery purchases, including those made online and at large supermarkets, as well as on gas. Despite the Citi Cash Back Card’s S$80 monthly cashback cap, it’s reassuring to know that you won’t need to spend exactly or almost exactly the same amount in each of these three areas to maximize your savings.

Highlights:

- Refer a friend and be rewarded with S$150 Cash

- Restaurants vouchers

- Receive base cashback and bonus cashback

Highly recommended despite waiting for 2 hours! Aloysius Yeoh, despite being a trainee was very patient and assist me to close my account that I had been trying to close for a year. Thank you so much! – Diaz Suz

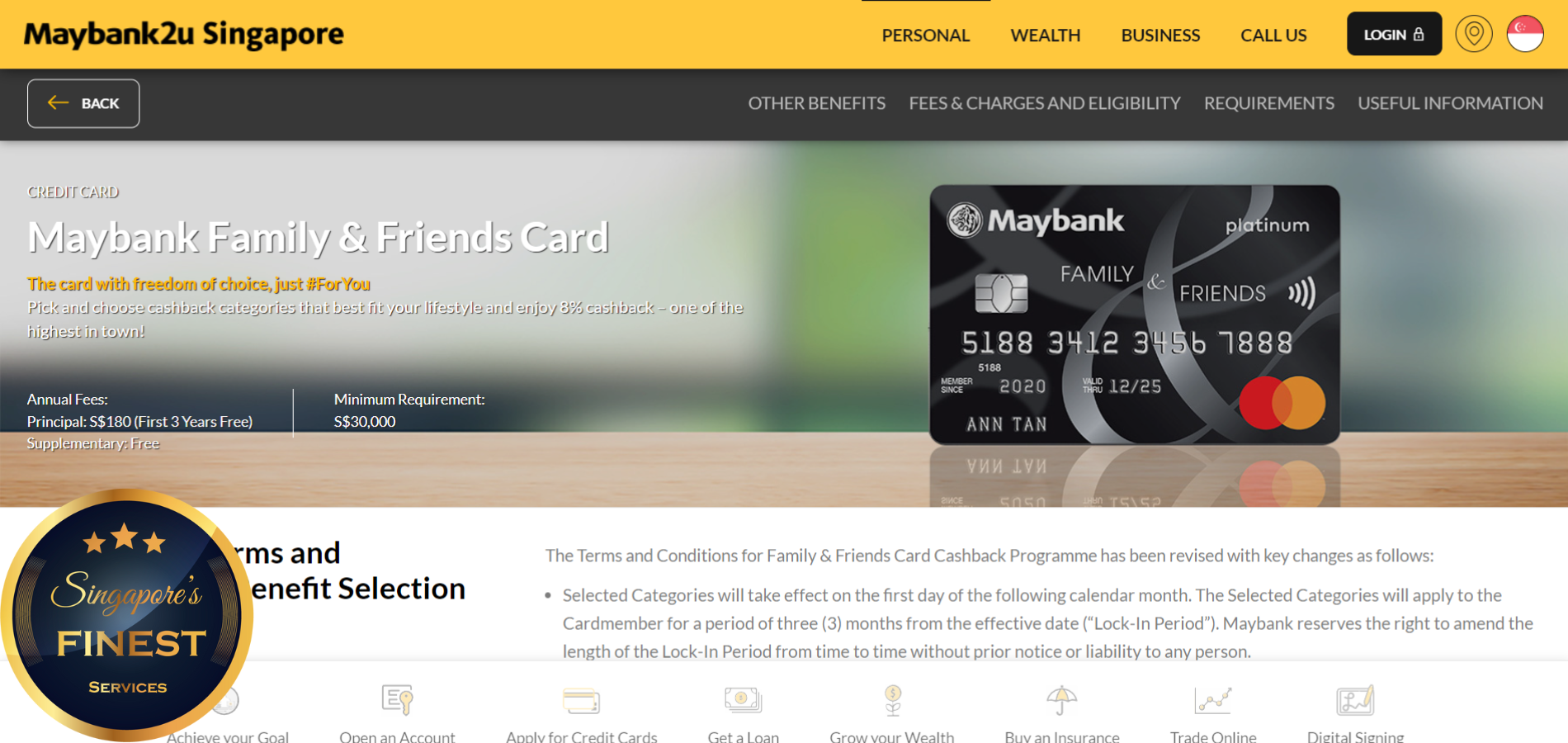

| Services | 3X interest on your child’s savings with Maybank Family Plus. Secure, fast, and cashless payments on the go with Mastercard contactless. Access to attractive Maybank Card privileges in Singapore, Malaysia, Indonesia, and the Philippines. |

| Price Range | |

| Contact Details | See here |

| Address | Branches |

| Website | https://www.maybank2u.com.sg/en/personal/cards/credit/maybank-family-and-friends-mastercard.page |

With savings starting at 1 point for every $1 spent, the Maybank Family & Friends Card offers up to 8% cashback on five different categories of purchases. This comprises your grocery, eating, and food delivery, as well as transportation, digital communication, and online TV streaming. It also includes retail and pets, as well as online shopping, entertainment, and pharmacy and wellness.

Highlights:

- Earn 8% cashback globally on your 5 preferred cashback categories from the list of 8 options

- Access to Samsung Pay

- 0.3% cashback applies to all other spendings on non-selected categories

Very good banking experience. Feel welcome by the customer service. Good knowledge of their banking product by the staff, Kenny. Highly recommend Maybank for our banking needs. Good rates too. – Noorzidah Mn

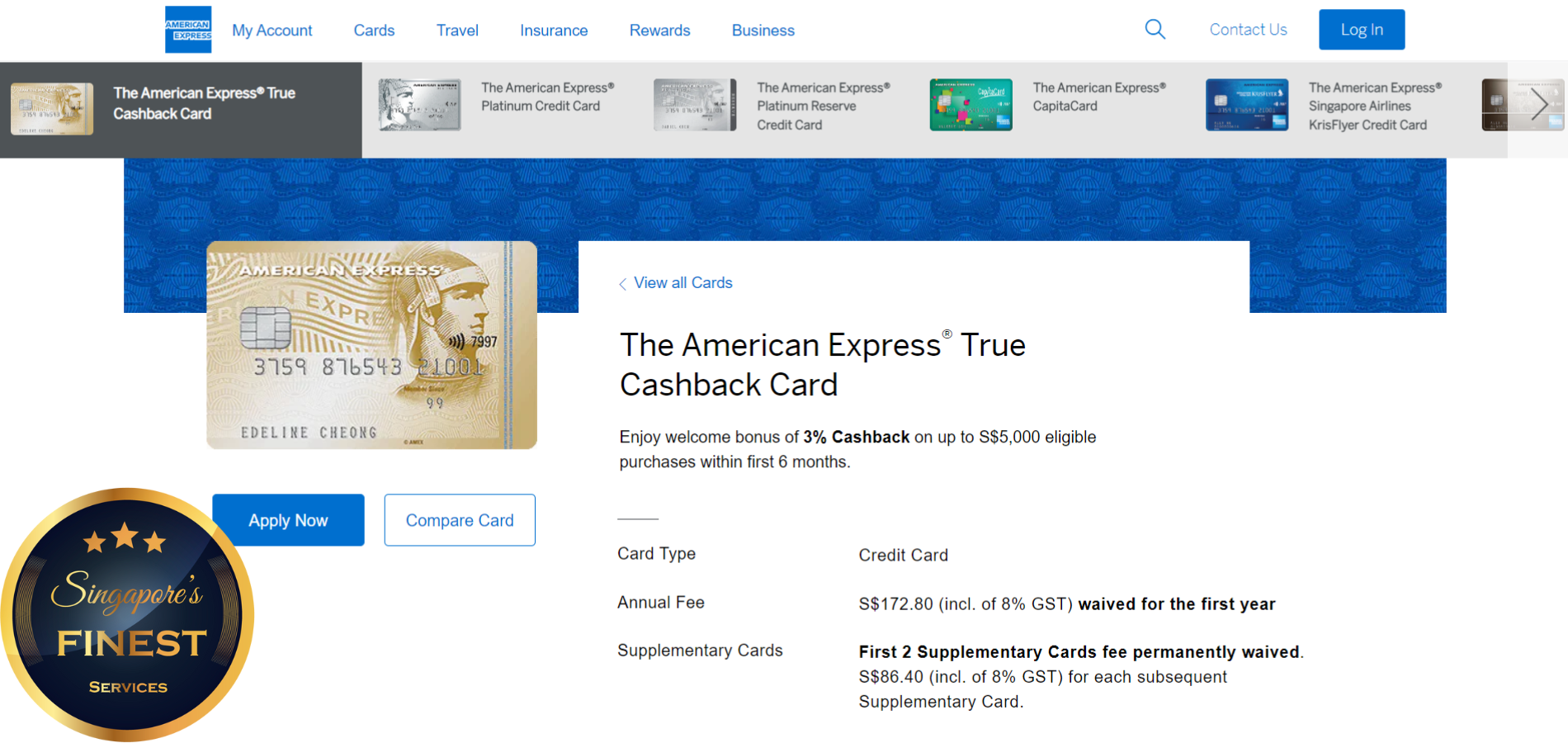

| Services | No minimum spend, no cap on Cashback, and no categories to track. Immediate Cashback in the same month’s statement. Earn 1% Additional Cashback at selected pet stores. Registration required. |

| Price Range | |

| Contact Details | See here |

| Address | Branches |

| Website | https://www.americanexpress.com/sg/credit-cards/true-cashback-card/ |

One of the first cards on the market to offer limitless cash back with no restrictions was the American Express True Cashback Card. Additionally, the first six months’ worth of purchases will earn 3 percent cashback, up to $5,000. Before applying for this card, you should be aware that it is wise to hold off and sign up right before embarking on an expensive life phase, such as moving to a new home or having a child. After spending a total of $5,000 or after six months, you will start to receive the standard rate of 1.5 percent. There is no cap on the amount of 1.5% cash back you can obtain, though.

Highlights:

- 24-hour Customer Care Professional

- Global Assist

- Fraud Protection

The best service from the call center is friendly, warm, and effective service!! thank you, Amex! – Thai Amulets Mart

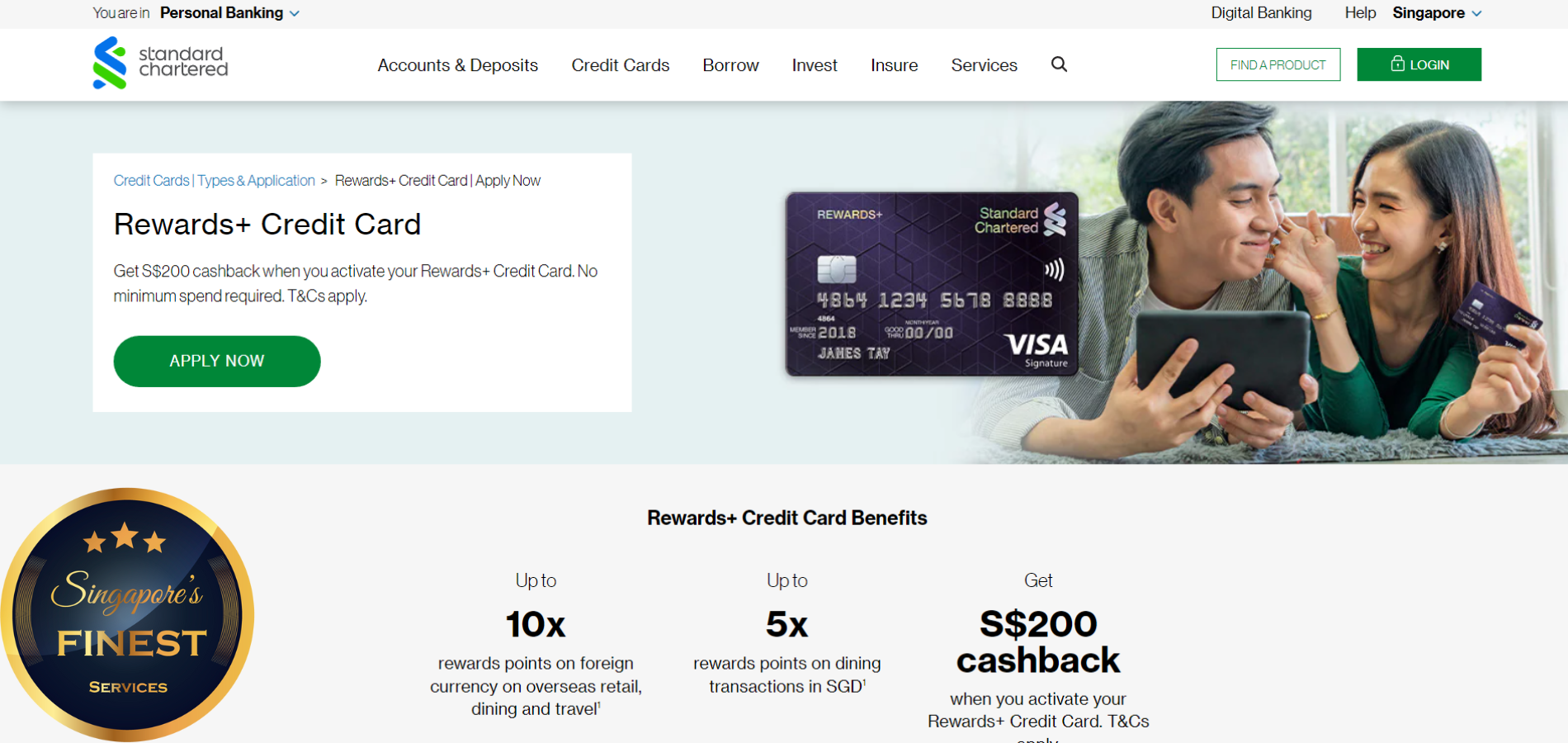

| Services | 10X rewards points on foreign currency on overseas retail, dining, and travel. 5X rewards points on dining transactions in SGD. |

| Price Range | |

| Contact Details | +65 1800 747 7000 |

| Address | Branches |

| Website | https://www.sc.com/sg/credit-cards/rewards-plus-credit-card/ |

Love purchasing from overseas internet retailers? With this credit card, make the most of your shopping extravaganza. Spend money outside of your home country and receive 10 points for every dollar. You receive five points for every dollar spent on dining.

Highlights:

- Get up to S$220 cashback

- Instant Digital Credit Card

- Fund Transfers

- Complimentary travel medical insurance

- SC EasyBill

Had a pleasant experience overall. Staffs were friendly and nice to me. Thank you Mr. Leon for patiently guiding me throughout the opening of the accounting process. – Jolene Chng

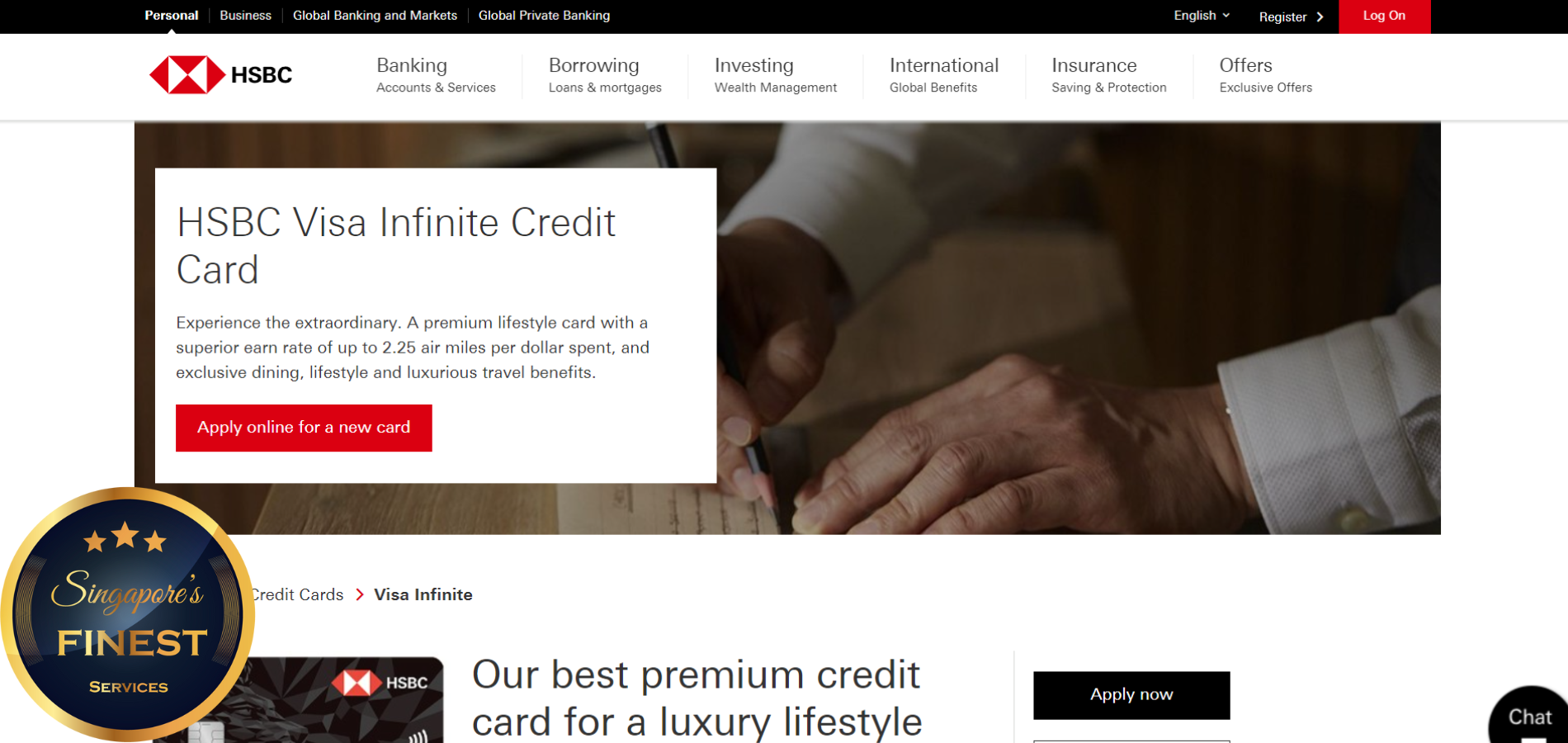

| Services | Exclusive dining and lifestyle offers, Unlimited airport lounge access, Get VIP treatment when you travel, Worldwide peace of mind, Earning more air miles, Personalised assistance, rewarded with additional cashback, Preferential annual fee |

| Price Range | |

| Contact Details | |

| Address | Branches |

| Website | https://www.hsbc.com.sg/credit-cards/products/visa-infinite/ |

Even if traveling might not be an option right now, this HSBC credit card makes accumulating miles simple. For every $1 spent, 2.25 air miles are earned. The benefits of travel don’t end there, either. You receive free limo transfers as well as access to more than 1,000 airport lounges throughout the world. absolute VIP treatment At Mandarin Oriental Singapore, take advantage of additional discounts on meals (up to 50% off) and spa services totaling 30%.

Highlights:

- Exclusive dining and lifestyle offers

- Unlimited airport lounge access

- Get VIP treatment when you travel

- Worldwide peace of mind

- Earn more air miles

- Personalized assistance

- Be rewarded with additional cashback

Friendly, quick, and service. They understand international needs. The only HSBC jade center in Singapore. Bank here. It’s worth it. – Colin Charles

| Services | Cashback card for online shopping |

| Price Range | |

| Contact Details | See here |

| Address | Branches |

| Website | https://www.dbs.com.sg/personal/cards/credit-cards/live-fresh-dbs-visa-paywave-platinum-card |

The DBS Live Fresh Card is a straightforward cashback credit card, but my parents won’t like it. There are absolutely no benefits for purchasing needs like food, fuel, or utilities. Instead, the incentive refunds are for online shopping, while the card perks are for dining and fashion.

Highlights:

- Singapore’s first eco-friendly credit card

- Up to 5% cashback

- Additional 5% Green Cashback

Joyce Calvelo provides excellent service during our visit to your branch. She works fast, efficiently, and accurately. Despite the long queue and limitations placed by the bank, we were pleased with her exemplary service. Thank you. – Nick Yau

Now that we’ve completed our fascinating exploration of Singapore’s credit card market, you’re well-equipped to make informed financial decisions. The range of credit card options is extensive, encompassing cashback rewards, travel benefits, and frugal spending techniques. With your newfound knowledge, pick a credit card that will help you achieve your financial goals while also fitting in with your lifestyle. With confidence, navigate the always-changing loan options and set out on a journey where each transaction is a calculated step toward your financial success. Greetings from a future where your selection of credit cards in Singapore will drive your financial emancipation.

Do check out our list of Mortgage Brokers and have your loan solutions.

Frequently Asked Questions

FAQs

Why should I get a credit card in Singapore?

What types of credit cards are available in Singapore?

How do I choose the right credit card for my lifestyle?

What are the key features and perks of credit cards in Singapore?

How can I maximize the benefits of my credit card?

What fees and charges should I be aware of when using a credit card?

How do credit cards contribute to building a good credit score?

Can I apply for a credit card with a limited income?

You might be interested in

Related Lists