OA Assurance PAC, a leading Singapore-based CPA firm, (“OA”) has found that many Companies would reconsider their existing professional service provider if given a choice but believe the cost of change is too high.

A recent survey of over 100 SMEs conducted by OA, revealed that 38.89% of respondents would reconsider engaging their existing professional service provider for their statutory audits; in addition, when considering new professional services providers, 61.11% say price is their Number One consideration — even over quality.

These findings demonstrate that many believe it’s impossible to find a firm that can deliver better quality without increasing costs.

Of all the services offered by a CPA firm, statutory audits are the most critical and finding practical auditors with high-quality service is key. Auditors should ensure a company meets its regulatory and business compliance requirements as well as reporting deadlines, while providing practical solutions for audit issues that arise because of the audit.

However, most of the Companies automatically associate this quality with increased cost — hence why many may be reluctant to make the switch.

Helping businesses save on the cost of compliance

Despite what many companies may believe, a lower cost does not need to come at the expense of quality. OA has rolled out a new digital roadmap that streamlines the auditing and client management process via cloud technology and automation — enabling them to deliver more cost-effective solutions for clients.

In 2019, OA Assurance adopted an innovative, cloud-based e-Audit platform making the audit and reporting processes more efficient and effective. Moving forward, the firm plans to introduce new accounting and tax-related services to the platform — ensuring digitisation provides convenience and lower costs continually.

OA Assurance believes that this continued digitisation, and the introduction of integrated communication and collaboration platform will further lower the cost of compliance without compromising the quality of services offered.

Providing practical solutions to business challenges

Beyond drafting high-quality, cost-effective audit findings, OA Assurance also recognises the need for an auditor to provide practical solutions to a company’s audit issues. “We often hear of complaints from prospective clients that auditors do not understand the nature of the business or the industry they are auditing, which results in delays and errors in the process. As experienced auditors, we believe prolonged, painful discussions between companies and their auditor do not need to happen,” said Alan Chang, Managing Director of OA Assurance PAC.

To combat this, OA Assurance proactively engage with clients to ensure there are no surprises. Combining their long-standing experience and comprehensive industry knowledge with effective auditing methodologies, OA Assurance provides professional, personalised audit services that not only identify issues but provide solutions.

Further to this, OA Assurance ensures companies meet ACRA reporting deadlines. In many cases, excessive meetings and inefficient processes can lead to delays, causing companies to miss reporting deadlines and attract penalties from the ACRA for late filing.

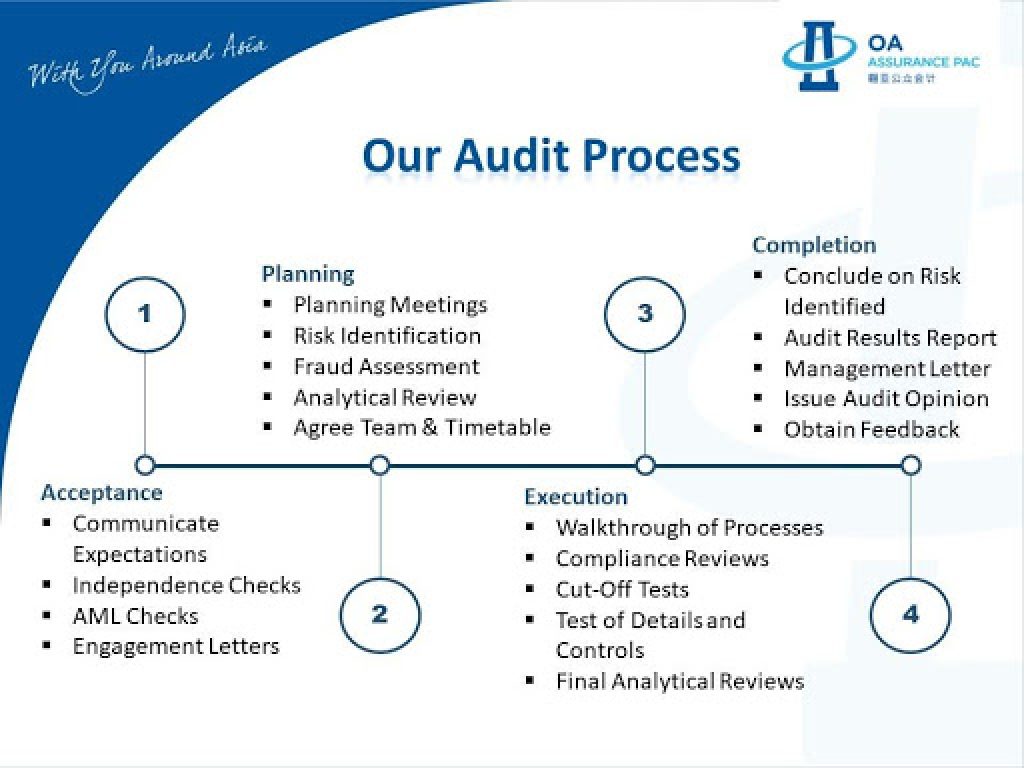

As an owner-managed business, OA Assurance recognises the need to complete an audit assignment within an acceptable time frame. The firm has developed a robust, streamlined auditing process to ensure speedy delivery with a KPI of ONE month from planning to completion.

Find Out How Digitisation is Lowering The True Cost of Compliance

“The digitisation of the OA Assurance service platform has enabled us to improve efficiency and reduce the cost of compliance for companies,” added Chang “the adoption of integrated communication and collaboration platform, we believe, will reduce the cost of compliance even further,” he concluded.

OA Assurance PAC works with businesses of all sizes, from start-ups and multi-national corporations, to owner-managed business and corporates. As a highly qualified, cost-effective auditor, all OA Assurance partners are accredited CPAs, having undergone and passed the ACRA’s practice monitoring review in the past three years.

With these advantages and in view of COVID-19 outbreak, OA Assurance PAC is willing to pass on these cost savings benefits to help reduce the cost of compliance, starting with a reduction in existing audit fees.

About the Company

OA Assurance PAC is a Singapore based Certified Public Accounting firm with over 20 years of combined experience. OA Assurance is supported by a local team of qualified professionals who aim to establish a reputation for elevating business by upholding a high standard of professional accounting practices and refining people with enriching experiences. Our team comprise of members from several professional accounting bodies in the region, Institute of Singapore Chartered Accountants (ISCA), Association of Chartered Certified Accountants (ACCA), Malaysia Institute of Accountants (MIA), CPA Australia, Hong Kong Institute of Certified Public Accountants (HKICPA) and ASEAN Chartered Professional Accountant. OA Assurance is also Approved Training Organisation for Singapore Chartered Accountants, CPA Australia and ACCA.

Services Provided

🖊 Statutory Audit

🖊 MCST Audit

🖊 Sales Audit/Gross Turnover Audit

🖊 Lucky Draw Audit

🖊 Special Reviews – Financial

🖊 Agreed Upon Procedures

🖊 Due Diligence for Mergers and Acquisitions

What OA Assurance’s Clients Say About Their Services

⭐⭐⭐⭐⭐

“The staff at OA Assurance are very knowledgeable and have provided us with a lot of assistance and advice. We can tell that they are truly sincere in providing holistic consultation to improve the company’s financial management as a whole. We look forward to continuing to work with them in the long term.” Karen Choo – Executive Secretary, Digimagic Communications Pte Ltd

⭐⭐⭐⭐⭐

“Our business is a leading fintech company and as is often the case, technology moves faster than accounting standards and precedents can be set. OA Assurance team has been an innovative partner in providing third-party audit services and putting in the effort to learn how our business works from the core to ensure our controls and policies meet the existing standards. We are thankful and highly recommend their service.” Luke Cheng – CFO, Omise Holdings Pte. Ltd.