The Goods and Services Tax (GST), which will rise from the current rate of 7% to 8% as we welcome 2023, is probably not something that most of us are overly thrilled about.

From January 1, 2023, Singapore will raise its goods and sales tax (GST) from seven to eight per cent. According to the state budget for 2022, the rise is just the first of two GST rate hikes that are anticipated. On January 1, 2024, there will be a second rise, again by one percentage point.

The administration has said that it will maintain the rise as planned despite rising inflation.

The increase was announced in the country’s 2022 state budget, which also said that the GST rate will rise from its current 7% to 9 % in two phases, by 1 % in each of the months of January 2023 and 2024.

Let us know first what GST is.

The majority of supplies of goods and services, as well as imports, are subject to the value-added tax known as GST.

Why is GST rising in Singapore? Spending on social programs is up.

The majority of the Singapore government’s yearly budget is allocated to social spending, primarily for healthcare.

The increasing aging population of Singapore is the source of the rise in social spending, particularly healthcare costs. By 2030, it’s predicted that close to one in four people would be above the age of 65. Thus, in order to lessen the financial burden of future healthcare expenses, the government is anticipated to construct additional hospitals and clinics as well as provide senior patients with prescription subsidies.

Singapore’s upcoming amendments to the GST

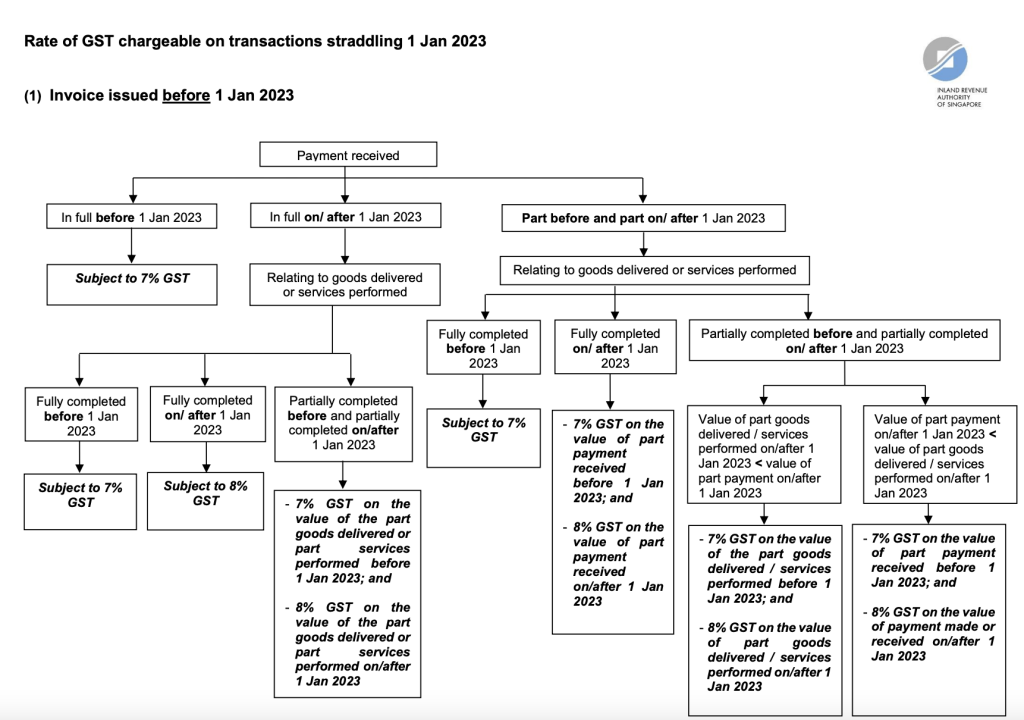

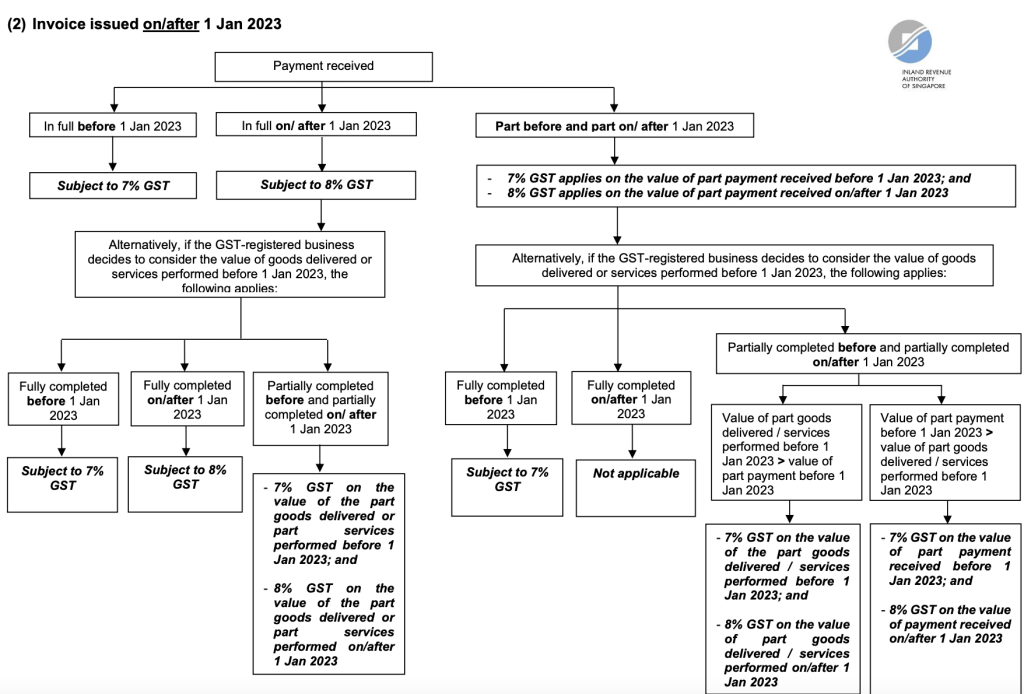

IRAS has generously provided a flowchart for consumers to use in understanding the various circumstances and how the GST hike may impact them:

You can also learn more details on the IRAS website about the GST increase that is happening on January 1 2023.